Not many reasons to cut interest rates further

- Apoorva Sonkar

- Aug 9, 2020

- 2 min read

3 charts indicating further rate cuts look unlikely unless certain things change:

1. Inflation beyond RBI's target rate of 4% +/- 2%: Below chart shows that CPI (consumer price index - for measuring inflation) had jumped out of the comfort zone in November 2019. Further cuts are likely to keep upwards pressure on inflation.

2. Negative Real Repo Rate?: Repo rate is the rate at which the central bank of a country (Reserve Bank of India in case of India) lends money to commercial banks in the event of any shortfall of funds. This is largely driven by 2 parameters: falling nominal interest rates and rising inflation.

This means that adjusted for inflation, borrowers make interest income rather than incurring interest expense. This is a scenario when monetary policy and other market forces push interest rates to near zero value in order to boost the economy. Some of the developed nations (EU nations, Japan, etc.) have had near zero or negative rates for some time now.

3. Unsatisfactory transmission of Repo rate-cuts: If the banks can borrow at lower rates (with falling Repo Rate) then they should lend at lower rates too, right? Well, it is not a linear function and every bank is likely to see its profitability before cutting its lending rate.

Subsequently, rates on deposits will fall too (in fact, this is happening if you check rates on savings account or Fixed Deposits) - this is something which consumers might not prefer.

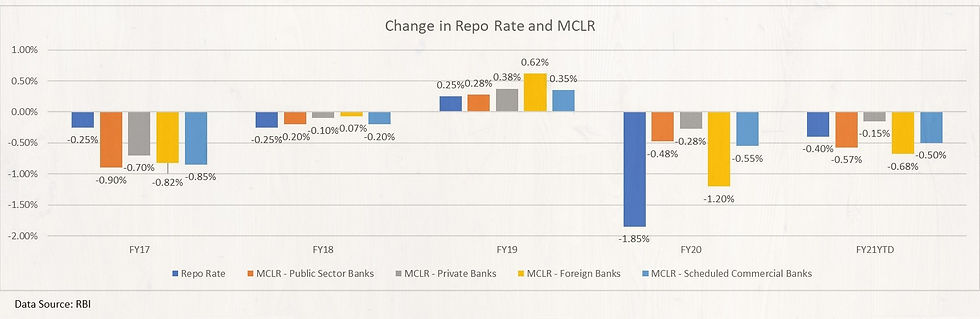

Taking into account the multiple number of factors that drive decision making on interest rates, it is seen that the transmission of rate cuts done by the RBI has not happened as expected. Below chart shows the quantum of rate cuts in different financial years for:

a) Repo Rate - By RBI

b) 1 year MCLR - By Public Sector Banks

c) 1 year MCLR - By Private Banks

d) 1 year MCLR - Foreign Banks

e) 1 year MCLR - Scheduled Commercial Banks (all above banks from b) to d))

Median value has been considered for Bank MCLR

MCLR: The marginal cost of funds-based lending rate (MCLR) is the minimum interest rate that a bank can lend at. MCLR is a tenor-linked internal benchmark, which means the rate is determined internally by the bank depending on the period left for the repayment of a loan. (Source: Mint)

Any views expressed are personal in nature. Before taking any position in any financial market, keep in mind that market securities do a random walk of their own and what has happened in the past might not happen in the future. Market securities move up and down - there is always a possibility that you get less than what you had invested.

Comments